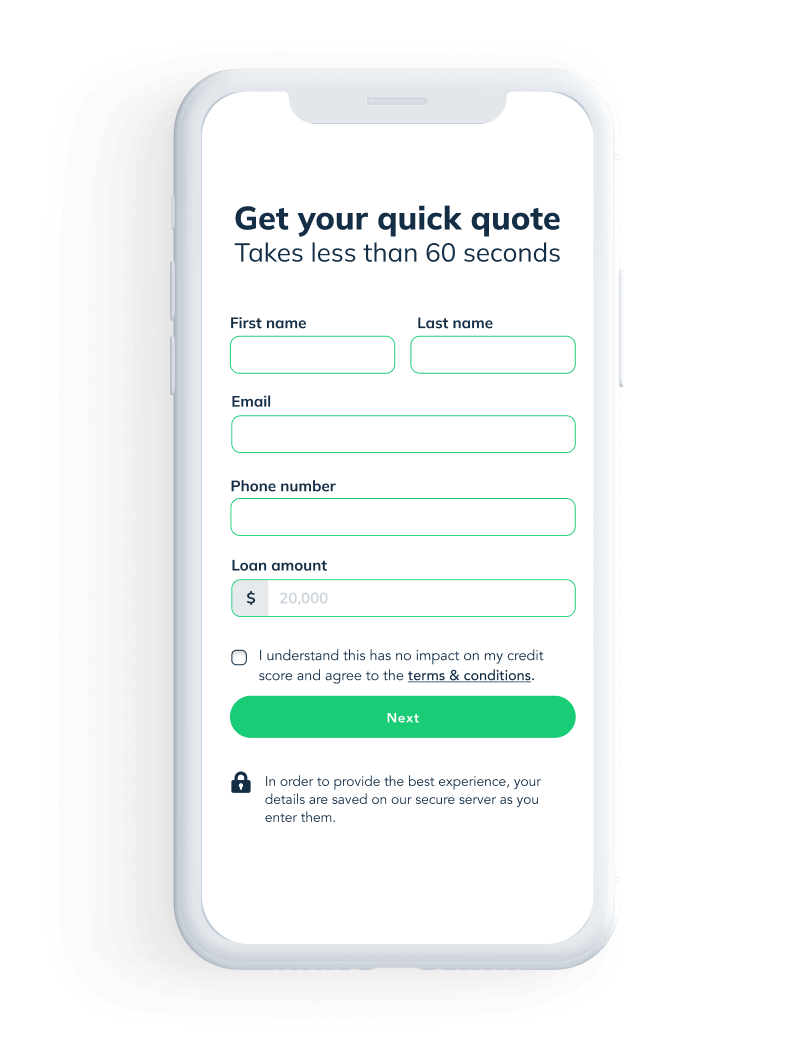

Step 1.

Submit your details

Answer a few simple questions to get your Free Quote.

Google

Google

Facebook

Facebook

Our total focus is achieving better interest rates and better loans for YOU.

Request Qoute

Jade Finance sourcing and providing a comprehensive range of business finance and personal loan services for both business owners and operators and individuals.

All types of business – SMEs, owner-operators, sole traders, large corporates - and private individuals of all ages and profiles are welcome to use our services.

Your Jade Finance consultant will do all the work for you. Assessing the loan options that meet your requirements from our vast lending panel and delivering you a better loan offer for your consideration. We save your valuable time plus you have our invaluable and in-depth specialist expertise and vast experience working for you.

Jade Finance is accredited with all the major banks and many finance companies and non-bank lenders. With more sources to cover, we have more options to find you the best deal that meets your requirements. We give you access to banks that you don’t even have an account with and non-bank lenders you may have never even heard of.

As fully-licensed brokers, we provide specialist services to seek options for bad credit, low docs and no docs loan applications.

Motor vehicle finance is one of the most competitive areas in the lending sector. Offers, promotions, deals and specials are widely advertised by car dealers, banks and finance companies to entice car buyers. Sorting out which car loan offer genuinely represents the best deal for you requires careful analysis. Jade Finance does all that for! No problems.

Jade Finance is a leading broker in the motor vehicle finance sector, accredited with many lenders so we have more choices to source you business car finance at better interest rates.

LOANS FOR CARS, UTES, SUVS, WAGONS, SEDANS, HATCHES, CONVERTIBLES, HYBRIDS.

BUSINESS VEHICLE FINANCE – LIGHT COMMERCIALS, SEDANS, UTES, WORKHORSES

LUXURY VEHICLES – FAMILY CARS – WORKHORSES – OFF-ROAD 4X4 – EVS

Whether you’re buying from a new or second hand car dealer, a private seller or at auction, Jade Finance can arrange you a better car loan based on our cheap interest rate guarantee.

Loans are structured to suit your individual requirements with terms negotiated to suit your weekly budget or work with your business cash flow.

Your Jade Finance consultant will handle the entire car loan process with our streamlined service to assist you to get behind the wheel of your new drive as fast as possible with the cheapest car loan. We can arrange a pre-approved loan so you’re organised before discussing price with the seller or heading to the auction. Find out more about Jade Finance Car Loans or Apply Now!

As a specialist marine finance broker, Jade Finance is accredited with a network of lenders that specialise in boat loans and marine finance. With our expertise in the area, our in-depth knowledge of the boating sector and our lender connections, we’re at the helm when it comes to charting a course to a boat loan that best suits you and your vessel.

We achieve cheaper interest rates for our boat loan customers because we know which lenders offer the best loan deals on various types of boats and we negotiate harder with them on your behalf. While most banks and finance companies have set rates and won’t budge, we have access to lenders that are more competitively minded and have greater flexibility to negotiate on rates and terms.

Loans for power boats, trailer boats, speed boats and runabouts.

Loans for sailing boats, recreational and yachts.

Luxury cruiser finance and tailored business charter vessel finance.

Jet Ski and wakeboard boat loans.

Loans for houseboats – stock models and custom, built-to-order vessels.

In the market to buy a boat? Click straight to our boat loans information to see how Jade Finance can assist you with a great boat loan to add more pleasure to your boating leisure.

Jade Finance are the experts when it comes to sourcing cheap trucks loans for all types of trucks for all types of truck owners. Our access to industry-only lenders that specialise in truck and heavy equipment finance gives us the edge in getting the best deals for our customers. These lenders are traditionally more competitive than the banks and for Jade Finance customers that means – better interest rates and cheaper truck loans.

Our consultants will structure your loan to best suit your requirements, whatever your business set-up and special circumstances. Even if you’ve been turned down by the bank for a truck loan, Jade Finance may be able to assist you.

Our cheap truck loans are available for truck only and truck-trailer combos, both new and used vehicles and the loan process is streamlined and easy. Your personal Jade Finance consultant will handle sourcing you the cheapest quote, the application processing and assist with the paperwork to save you valuable time and save you money over the term of the loan.

For more information on truck loans or just give us a call for an obligation-free discussion. 1300 000 008.

One of the greatest appeals of the caravan lifestyle is the freedom and flexibility it offers. But if you’ve purchased your caravan with a loan that is over-stretching your weekly budget and tying you down – that freedom and enjoyment may be short-lived.

Jade Finance provides finance that is structured to suit the lives and lifestyles of our caravan customers and based on our better interest rates. Whether you’re buying an off-road or an on-road caravan, camper-trailer or motorhome, Jade Finance will keep your caravan loan on track with your adventure plans.

We’re known as the leisure finance specialists because we offer better rates and better loans on all types of caravans. Our consultants take the time to understand your needs and source you the loan that best meets your requirements.

If you’re looking to enjoy the freedom and flexibility of the caravan lifestyle, discover how Jade Finance can assist. For more information on caravan finance.

Acquiring new equipment and machinery is usually a major business decision with the focus on ensuring the entire purchase price and finance deal package will work towards delivering you a positive outcome. Jade Finance specialises in equipment finance as we have access to expert lenders in this sector that consistently deliver our customers the most cost-effective finance deals.

With the high price of many types of equipment, we focus on achieving the cheapest fixed interest rates to reduce the overall cost of the finance. With some loans in this category stretching over 7-10 years, that cheaper rate we achieve for you at the outset can add up to a significant cost saving over the finance term compared with what you may be offered elsewhere.

Tailored Equipment Finance for All Types of Businesses in Many Industries

Jade Finance is YOUR equipment finance specialist that works for YOU. If you want your machinery and equipment to do its best work for you, talk to us about a better equipment finance deal

If you’re upgrading, replacing, innovating, pivoting, expanding or resourcing for new projects, find out more about the equipment and machinery options and offers we have available.

Whether you’ve got your eye on a street bike, a tourer, an adventurer, a dirt bike, off-road, a bobber, enduro, motorcross, racer or a classic, Jade Finance can source you a quote for a cheap motorbike loan. Our finance broker services are available to individuals seeking loans for all types of rides and we consistently achieve better motor cycle loans for our customers.

While you focus on what set-up you want for your ride, your Jade Finance consultant will be focussing on negotiating you the best interest rate on your bike loan. We negotiate hard with the banks and lenders using our strong bargaining power to get the rate down to corner you the best loan.

Whether you’re after Harley Davidson Finance, a loan on a Yamaha, Suzuki, BMW, Honda, Kawasaki, Ducati, Triumph or a new Sherco, Jade Finance offers Secured Bike Loans and Unsecured Personal Loans for new and used bikes.

If you’re in the market for a new ride, see how Jade Finance can assist with the right loan gear.

Embarking on the path of personal financing, be it for debt consolidation, home improvement, or a dream vacation, can often feel daunting. Jade Finance emerges as your guiding light, expertly navigating the vast sea of loan options to land you the best deal. Our speciality lies in personal loan brokerage, a service meticulously designed to align with your unique financial needs and goals.

At Jade Finance, we understand that every individual’s financial landscape is unique. That’s why we offer personalized loan solutions, ensuring that each client receives a package that resonates with their specific requirements. Our offerings include diverse loan options like debt consolidation loans, unsecured personal loans, and more, all curated to provide you with optimal financial flexibility.

We pride ourselves on our ability to secure competitive, low-rate finance options. By partnering with over 80 trusted lenders, including major banks and niche finance companies, we leverage our extensive network to ensure you receive the best personal loan rates available. Our commitment to beating the interest rates offered by big banks sets us apart as a leading personal loan broker in the industry

Our process is streamlined for your convenience. Starting with a simple submission of your details, we embark on a quest to find your ideal loan. Our skilled consultants handle the intricacies, from comparing rates to negotiating terms, thus saving you valuable time and effort. You are only a few steps away from starting your financing journey with a lender that suits your needs perfectly.

Jade Finance simple fast approval application process quickly delivers back all the information you need to help you make the right choices on your finance needs. We pride ourselves on delivering better loan interest rates. Simply you will find our loan packages hard to beat.